Financial Inclusion Monitor

in Mexico

Reference Framework

The G-20 and other international bodies like the World Bank have drawn attention to the importance of financial inclusion in economic growth and development.

The National Development Plan in the Eje México Próspero addresses the promotion of financial inclusion, so that the benefits offered by the formal financial system are extended to all Mexicans.

Declaración Maya includes — among its priorities — financial inclusion data collection and use.

In Mexico, 44% of the adult population does not have commodities within the formal financial system (savings, credit, insurance, or retirement funds). Additionally, 64.5% does not save on instruments of this system. (National Financial Inclusion Survey, 2012)

Regulatory Framework

International Framework for Banks (Basel III)

According to the Bank for International Settlements, “Basel III” is a comprehensive set of reforms developed by the Basel Committee on Banking Supervision to enhance the regulation, supervision, and risk management in the banking sector.

These measures seek to:

- improve the banking sector capacity to cope with shocks caused by financial or economic stresses of any kind,

- improve risk management and good governance in banks,

- strengthen transparency and disclosure of bank information.

The reforms are aimed at:

- the regulation of banks to individual securities (micro-prudential dimension), to increase the responsiveness capacity of each institution in periods of tension

- systemic risks (macro-prudential dimension) that may accumulate in the banking sector as a whole, as well as the pro-cyclical amplification of these risks over time.

Given that increasing the resistance of each bank reduces the risk of alterations in the whole system, these two dimensions complement each other.

Mexican Financial Reform in 2014

On May 8, 2013, the Mexican President Enrique Peña Nieto sent to the Mexican House of Representatives the Initiative that would reform the financial sector in Mexico.

This Decree amended, added, and repealed various provisions of the Financial Services User Protection and Defense Act, the Financial Services Transparency and Ordering Act, the Credit Institutions Act, and the National Fund for Workers’ Consumption Institute Act.

On January 10, 2014, it was published in the Official Journal of the Federation

Institutional Framework

Alliance for Financial Inclusion

Since 2009, the Alliance for Financial Inclusion, an international network of financial policy makers across different countries, seeks to increase access to financial services for the poor.

International Financial Inclusion Forum

On June 26, 2014, the International Financial Inclusion Forum was held in Mexico, at Palacio Nacional. By sharing international experiences, it aimed to highlight the importance of national strategies for the effectiveness of financial inclusion public policies.

Market: Supply and Demand for Financial Services

Mexican Financial Inclusion Survey (ENIF, in Spanish)

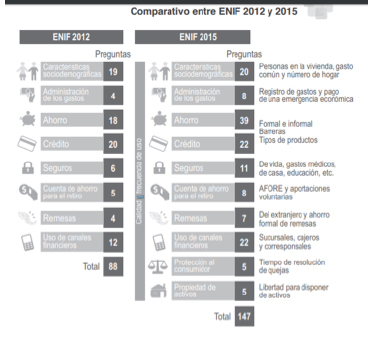

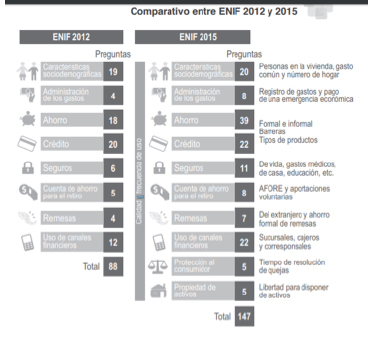

The Mexican and Securities Commission (CNBV, in Spanish) and the Mexican Institute of Statistics and Geography (INEGI, in Spanish) conducted the Mexican Financial Inclusion Survey (ENIF).

The ENIF aims to create information fundamental in designing public policies regarding financial services and products access and use, as well as national official indicators that might allow public agencies to diagnose and establish short- and long-term goals.

Financial Inclusion Monitor

in Mexico

Reference Framework

- The G-20 and other international bodies like the World Bank have drawn attention to the importance of financial inclusion in economic growth and development.

- The National Development Plan in the Eje México Próspero addresses the promotion of financial inclusion, so that the benefits offered by the formal financial system are extended to all Mexicans.

- Declaración Maya includes — among its priorities — financial inclusion data collection and use.

In Mexico, 44% of the adult population does not have commodities within the formal financial system (savings, credit, insurance, or retirement funds). Additionally, 64.5% does not save on instruments of this system. (National Financial Inclusion Survey, 2012)

Regulatory Framework

International Framework for Banks (Basel III)

According to the Bank for International Settlements, “Basel III” is a comprehensive set of reforms developed by the Basel Committee on Banking Supervision to enhance the regulation, supervision, and risk management in the banking sector.

These measures seek to:

- improve the banking sector capacity to cope with shocks caused by financial or economic stresses of any kind,

- improve risk management and good governance in banks,

- strengthen transparency and disclosure of bank information.

The reforms are aimed at:

- the regulation of banks to individual securities (micro-prudential dimension), to increase the responsiveness capacity of each institution in periods of tension

- systemic risks (macro-prudential dimension) that may accumulate in the banking sector as a whole, as well as the pro-cyclical amplification of these risks over time.

Given that increasing the resistance of each bank reduces the risk of alterations in the whole system, these two dimensions complement each other.

Mexican Financial Reform in 2014

On May 8, 2013, the Mexican President Enrique Peña Nieto sent to the Mexican House of Representatives the Initiative that would reform the financial sector in Mexico.

This Decree amended, added, and repealed various provisions of the Financial Services User Protection and Defense Act, the Financial Services Transparency and Ordering Act, the Credit Institutions Act, and the National Fund for Workers’ Consumption Institute Act.

On January 10, 2014, it was published in the Official Journal of the Federation

Institutional Framework

Alliance for Financial Inclusion

Since 2009, the Alliance for Financial Inclusion, an international network of financial policy makers across different countries, seeks to increase access to financial services for the poor.

International Financial Inclusion Forum

On June 26, 2014, the International Financial Inclusion Forum was held in Mexico, at Palacio Nacional. By sharing international experiences, it aimed to highlight the importance of national strategies for the effectiveness of financial inclusion public policies.

Market: Supply and Demand for Financial Services

Mexican Financial Inclusion Survey (ENIF, in Spanish)

The Mexican and Securities Commission (CNBV, in Spanish) and the Mexican Institute of Statistics and Geography (INEGI, in Spanish) conducted the Mexican Financial Inclusion Survey (ENIF).

The ENIF aims to create information fundamental in designing public policies regarding financial services and products access and use, as well as national official indicators that might allow public agencies to diagnose and establish short- and long-term goals.